Action Required: You Must Register to Access Online Banking

Starting Monday, August 4, at 11 a.m.

Every member must complete a one-time registration in our updated online banking platform after the system upgrade is complete on Monday, August 4, at 11 a.m.

Please note: You won’t be able to log in until you’ve registered. Taking this quick step will ensure uninterrupted access to your accounts, payments, and other online services.

View Online Banking Instructions

View Instructions On Setting Up External Accounts

View Telephone Banking Instructions

We are currently experiencing high call volumes and longer wait times.

For step-by-step instructions on online banking, telephone banking, and setting up external accounts, please see the instructions above.

If you’re still unable to access your account after following the registration steps, please remain on the line for further assistance.

A Better, Bolder Member Experience Is Almost Here: Service Interruption July 31–Aug 4

Credit Union Closure:

- The FreeStar Financial call center and all branches will be closed Friday, August 1, and Saturday, August 2.

- Call Center and branches will reopen for business at 9:00 a.m. on Monday, August 4.

Debit Cards:

- Debit card transactions and ATM withdrawals will have a combined limit of $250 per day starting at 5:00 p.m. Thursday, July 31, and will return to normal daily limits by 9:00 a.m. on Monday, August 4.

- Members are encouraged to come into our branches by Thursday, July 31, before 5:00 p.m. to get any extra cash that they will need for the weekend while our offices are closed and ATMs are offline.

Online and Mobile Banking:

- Members will not be able to access online banking after 5:00 p.m. on Thursday, July 31.

Members currently enrolled in online banking will need to re-enroll on or after August 4, at 11 a.m. - The new online banking system will become available to members at approximately 11:00 a.m. on Monday, August 4.

- Schedule any new bill payments in FreeStar Financial’s Bill Pay before July 27. After this date, you will not be able to schedule, edit, or cancel payments within our Bill Pay or External Transfer services until our new system launches on August 4 at 11 a.m.

- To complete bill payments due between July 27 and July 31, you must initiate payments directly from your external account (such as another bank or the biller’s website). Payments cannot be initiated from FreeStar Financial’s Bill Pay or External Transfers until August 4 at 11:00 a.m. Existing scheduled payments cannot be changed during this period.

- Payments already scheduled to process between July 28 and August 1 will be sent as planned.

- Payments scheduled for August 2 or August 3 will be sent on August 4.

- Android users: Mobile banking now requires downloading a new app in the Google Play Store to continue accessing your account.

- Apple users: Mobile banking will require an app update that you initiate in the App Store.

ACH:

- Regular August 1 direct deposits (ACH deposits) will post to accounts on or before July 31.

LoanPay Xpress:

- This program will no longer be available after 4:00 p.m. on Wednesday, July 30, for new payments.

- Any loan payments that were made through a recurring ACH will be transferred to the new banking system and will continue to be processed.

- Anyone who has been making payments using their debit or credit card will need to set up an alternative method through online banking.

Telephone Banking (formally known as Magic Touch):

- Telephone banking will be unavailable beginning at 5:00 p.m. on Thursday, July 31.

- The new telephone banking platform will go live at approximately 11:00 a.m. on Monday, August 4.

- NEW TELEPHONE BANKING NUMBER: 888-590-8892

- Re-enrollment: Members will need to re-enroll in the new telephone banking system.

View Telephone Banking Instructions

E-Statements:

- History of member E-Statements will not be available after the conversion to the new online banking system. All members should download and save statements for your own records. Statements will not transfer from the old online banking to the new online banking system.

Shared Branching Centers:

- FreeStar Financial members will not be able to use shared branching centers beginning at 5:00 p.m. on Thursday, July 31.

- Shared branching centers will be available again for members beginning at 9:00 a.m. on Monday, August 4.

Credit Cards:

- FreeStar Financial credit card transactions will continue to be processed normally with no additional restrictions in place.

A Better, Bolder Member Banking Experience.

Taking Your Dreams Higher With A Technology Systems Upgrade

FreeStar Financial is working hard to bring you a better banking experience in 2025. The technology systems upgrade that will take place later this year will allow FreeStar to serve you more efficiently, provide enhanced product offerings, and allow access to a more robust online and mobile platform and mobile app experience. FreeStar is preparing to take your member banking experience higher!

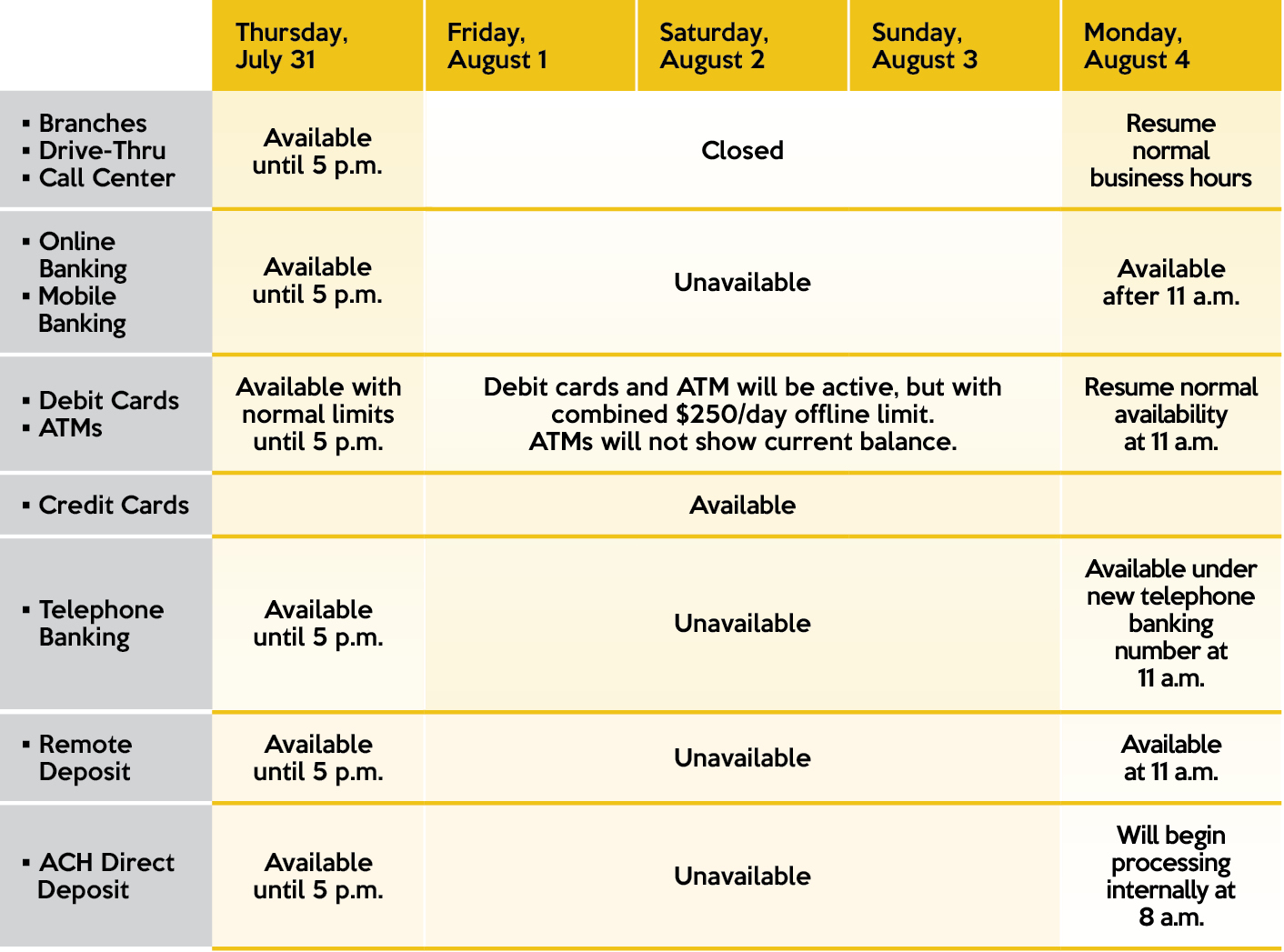

Systems Upgrade Schedule

Below is a schedule of the systems upgrade weekend that is set to take place Thursday, July 31, through Monday, August 4. This schedule outlines what will be available or unavailable, when it will take place, actions to take, and when you can expect things to resume normal availability.

Be sure to visit freestarfinancial.com/upgrade for the most up-to-date information and postings of any schedule changes or needed actions.

Technology Systems Upgrade Checklist

Stay informed about the Freestar Financial technology systems and member experience upgrade! You may receive informational emails from FreeStar Financial regarding the upgrade.

Visit freestarfinancial.com/upgrade for the most up-to-date information. Follow our upgrade checklist below to make sure you’re prepared.

- Verify that FreeStar Financial has your up-to-date contact information on file, including your current email address and phone number. You can check on this through online or mobile banking.

- Check in on the upgrade at freestarfinancial.com/upgrade at regular intervals. Make sure to check back right before the weekend of the upgrade.

- Check out the FreeStar Financial Facebook page for additional update information.

- Share information about the upgrade with joint account owners who may not receive the emails and mailings.

- Schedule any new bill payments in FreeStar Financial’s Bill Pay before July 27. After this date, you will not be able to schedule, edit, or cancel payments within our Bill Pay or External Transfer services until our new system launches on August 4 at 11 a.m.

- To complete bill payments due between July 27 and July 31, you must initiate payments directly from your external account (such as another bank or the biller’s website). Payments cannot be initiated from FreeStar Financial’s Bill Pay or External Transfers until August 4 at 11:00 a.m. Existing scheduled payments cannot be changed during this period. Payments already scheduled to process between July 28 and August 1 will be sent as planned. Payments scheduled for August 2 or August 3 will be sent on August 4.

- Finish any loan applications, new account openings, or transfers before Thursday, July 31.

- The final time to initiate a loan closing is 3:30 pm on Thrusday, July 31st. After that time, loan closings are paused until Monday, August 4th.

- Take out enough cash to have on hand before the upgrade weekend to avoid issues with branch and ATM unavailability.

- Plan to not make any large purchases with your FreeStar Financial debit or credit cards during the weekend of the upgrade.

- If you need to take out cash over the upgrade weekend, note your balances before Thursday, July 31, to ensure that your account does not become overdrawn.

- Get ready for the FreeStar elevated member experience and new tools!

Handy Resource Tools

Upgrade Updates

freestarfinancial.com/upgrade

Facebook Updates

https://www.facebook.com/freestarfinancial

Account Questions

Email:

Member Services: memberservices@freestarfinancial.com

Loan Information: lending@freestarfinancial.com

Mortgage Information: mortgages@freestarfinancial.com

Phone:

Phone number: 586-466-7800

- Opt. 1 Account balances and transfers

- Opt. 2 Real estate lending (mortgages)

- Opt. 3 Loans, Visa

- Opt. 4 Debit card questions

- Opt. 5 Online banking, bill pay, mobile app

- Opt. 6 Repayment solutions

- Opt. 7 All other questions/upgrade questions

- Opt. 8 Hours and locations

Go to main navigation